NATIONAL INCOME

INTRODUCTION

Income level is the commonly preferred tool used to determine the well-being and happiness of the nations and their citizens.

This remains true today also, even if we know that “income’ is not an exhaustive idea to know about the well-being of the society.

There has been some reason for such a perception of the concept of income.

In simple terms, the concept of “human development” emerged in the early 1990s, and the idea of the “human development index” ultimately rested mainly on the amount of “income that each individual in a nation earned.”

It is only after the necessary funds have been raised that life expectancy and education may be improved.

Income thus became recognized as the “focal point” of “development/human development” in some way.

As the income of a single person can be measured, it can be measured for a nation and the whole world, although the method of calculating may be a little bit complex in the latter’s case. In due course of time, four ideas/ways to calculate the income of a nation developed which are the subject matter of the ‘national income accounting.

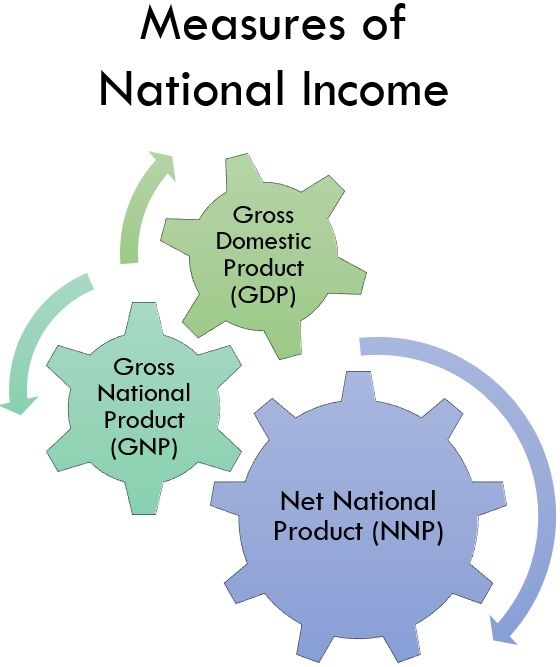

These four ways to look upon ‘income of an economy are the concepts of

1. Gross Domestic Product (GDP)

2. Net Domestic Product (NDP),

3. Gross National Product (GNP) and All are different from one another but they are the forms of the national income.

4. Net National Product (NNP).

They all say a different story about the income of a nation in their own specific way. Gross Domestic Product (GDP)

Gross Domestic Product (GDP) is the value of all final goods and services produced within the

physical boundary of a nation during one year.

For India, this calendar year is from 1st April to 31st March.

Grow, which means the same thing in Economics as “total” means in Mathematics: “Domestic’ means all economic activities done within the boundary of a nation/country and by

its own capital; ‘Product’ is used to define ‘goods and services’ together, and ‘final’ means the stage of a product after which there is no known chance of value addition in it.

Below are some of the many applications for which the GDP idea is used: The “growth rate of an economy” is the percentage change in it per year. When an economy is described as “growing,” it means that its income is increasing, or putting it quantitatively.

It is a “quantitative” idea, and its size and volume reflect the economy’s “internal” strength.

Regarding the “qualitative” aspects of the goods and services generated by the economy, however, it says nothing.

The IMF/WB uses it in their comparative evaluations of its member countries.

NDP (Net Domestic Product) – GDP – Depreciation

GDP is measured as Net Domestic Product (NDP), which is the GDP after “depreciation” is weighted appropriately.

Basically, it is the net form of the GDP, that is, GDP minus the total value of the ‘wear and tear’ (depreciation) that happened in the assets while the goods and services were being produced. Every asset (except human beings) go for depreciation in the process of their uses which means they wear and tear

The governments decide and announce the rates by which assets depreciate.

The rate of depreciation is fixed by the Ministry of Commerce and Industry in india. NDP of an economy has to be always lower than its GDP for the same year since there is no way to cut the depreciation to zero. But mankind has achieved too much in this area through developments, such as ‘ball bearing’ “Jubricants’, etc., all innovated to minimise the levels of depreciation. The different uses of the concept of NDP are as given below:

For domestic use only: To understand the historical situation of the loss due to depreciation to the economy. Also used to understand and analyse the sectoral situation of depreciation in industry and trade in comparative periods.

To show the achievements of the economy in the area of research and development which

have tried cutting the levels of depreciation in a historical time period.

However, NDP is not used to compare the economies of the world because of the different rates of depreciation set by the different economies of the world. Depreciation in the Domestic Currency

The other way it is used in the external sector while the domestic currency floats freely as against the foreign currencies. If the value of the domestic currency falls following the market mechanism in comparison to a foreign currency. sa It is a situation of ‘depreciation’ in the domestic currency, calculated in terms of loss in value of the domestic currency.

Gross National Product (GNP) GNP-GDP Net Income From Abroad)

Gross National Product (GNP) is the GDP of a country added with its ‘net income from abroad’. Here, the trans-boundary economic activities of an economy are also taken into account.

The items which are counted in the segment ‘Income from Abroad’ are:

1. Private Remittances

2. Interest on External Loans

3. External Grants

The total amount that comes in and goes out of the economy as a result of “private transfers” made by foreigners employed in India and Indian nationals working abroad (to their place of origin).

India is now the country that receives the most private remittances worldwide.

2. Interest of External Loans: The net outcome on the front of the interest payments i.e. balance of the inflow (on the money lend out by the economy) and the outflow (on the money borrowed by the economy) of the external interests.

In India’s case, it has always been negative as the economy has been a ‘net borrower’ from the world economies.

3. External Grants:

The net outcome of the external grants i.e., the balance of such grants which flow to and from India.

Today, India offers more such grants than it receives.

• India receives grants (grants or loan-grant mix) from few countries as well as UN bodies (like the UNDP) and offers several developmental and humanitarian grants to foreign nations. Ultimately, the balance of all the three components of the ‘Income from Abroad segment may

turn out to be positive or negative. it has been always negative, in India’s case.

The heavy outflows on account of trade deficits and Interest payments on foreign loans are the reasons for the negative income of Indian from abroad.

Therefore, the general expression (or formula) for India follows such as

GNP = GDP-Income from Abroad

This means that India’s GNP is always lower than its GDP.

Many uses of the concept GNP are as given below:

This is the ‘national income’ according to which the IMF ranks the nations of the world in terms of the volumes-at purchasing power parity (PPP).

It is the more exhaustive concept of national income than the GDP as it indicates about the ‘quantitative’ as well as the ‘qualitative’ aspect of the economy, Le., the ‘external” as well as the ‘internal’ strength of the economy.

◊ it enables us to learn several facts about the production behaviour and pattern of an economy,

such as the extent of dependency of the outside world, its dependency on the world, standard

(or quality) of a nation’s human resource in international parlance, etc.

Net National Product (NNP)

NNP-GNP-Depreciation NNP = GDP + Net Income from Abroad – Depreciation

Net National Product (NNP) of an economy is the Gross National Product (GNP) after deducting the loss due to ‘depreciation’.

This is the purest form of the income of a nation called National Income (NI). Though, the GDP, NDP and GNP, all are ‘national income’ they are not written with capitalised ‘N’ and ‘T’.

Per Capita Income (PCI) When we divide NNP by the total population of nation we get the ‘per capita income’ (PCI) of that

nation i.e. ‘income per head per year.

Here, the rates of depreciation followed by the different natioris make a difference when the NI of the nations are compared by the international financial institutions like the WB, IMF, ADB, etc.

As the economies are free to fix any rate of depreciation for the assets. the nation.

Higher the rates of depreciation lower the PCI of

‘Cost’ and ‘Price’ of National Income

The issues related to ‘cost’ and ‘price’ also needs to be decided, while calculating national income.

Basically, there are two different sets of costs and prices such as Cost-Factor Cost and Market Cost

◆Price-Current Price and Constant price An economy needs to decide (or choose) at which of the two costs and two prices it will calculate its national income.

At present, India uses mainly Factor Cost and Constant Price.

COST

Income of an economy Le. value of an economy’s total produced goods and services may be calculated at either the ‘factor cost’ or the ‘market cost’.

1. Factor Cost: Basically, lactor cost’ is the cost of the inputs (or “input cost’) the producer has to incur in the process of producing

something. Such as the cost of capital le. raw materials, interest on loans, labour, rent, power, etc. This is also termed as ‘production cost/price’ or ‘factory price’.

This can simply be termed as ‘price’ of the commodity from the producer’s side

2. Market Cost

Market Cost-Factor Cost Indirect Taxes

While the ‘market cost is derived after adding the indirect taxes to the factor cost of the product

It means the cost at which the goods reach the market to sell them to consumers. These are paid by the producers to the Government of India such as GST.

This is also known as the factor price’ and ‘market price’.

PRICE

Income can be derived at two prices-Current and Constant.

The difference in the prices at current and constant prices is only that of the impact of inflation. Inflation is considered stand still at a year of past in the case of the constant price while in the

current price the present day inflation is added. The year of the past is also known as the ‘Base year’

The base year in India is 2011-12 since January 2015. Basically, Current price is the maximum retail price (MRP) which we see printed on the goods selling in the market.

CALCULATION OF INDIA’S NATIONAL INCOME

India officially used to calculate its national income at factor cost.

Since January 2015, the CSO has switched over to calculating it at market cost (i.e., market price). And its national income is calculated at constant prices.

Similar is the situation among the developing economies while the developed nations calculate it

at the current prices.

Though, for the statistical purposes, the CSO releases the national income data at the current prices, too.

Why developed economies calculate their NI at Current price? Unlike India, among the developed nations, inflation has been around 2 percent for many de cades that means it has been at lower levels and stable, too.

This is why the difference between the incomes at constant and current prices among them are narrow and they calculate their national income at current prices.

They get more reliable and realistic data of their income. Why is this data needed in India?

Basically, Inflation has been a challenging aspect of policy making in India because of its stability (how stable it has been) and the level of inflation (i.e. range in which it dwindles).

In such situations, the growth in the income levels of the population living below the poverty level (BPL) can never be measured accurately.

Because due to the higher inflation the section will show higher income. Hence, the Government will never be able to measure the real impact of the poverty alleviation programmes it runs for the population.